NRC

Read the article in NRC

The mental health sector is doing well. At least, that’s the first conclusion you might reach when reading annual reports from mental health care providers. But in practice, things are quite different. Several providers indicate that their financial situation is under serious pressure, and they’re finding it difficult to keep their heads above water.

In this study, we examine the financial health of large integrated mental health care providers. Is there indeed another world hidden behind these positive figures? To what extent are providers sustainably strengthening their financial position due to good operational results? And to what extent are they getting a temporary boost by “selling off the family silver” – in this case, real estate? What are the differences between providers, and what lessons can be learned to sustainably improve the overall financial position of this sector?

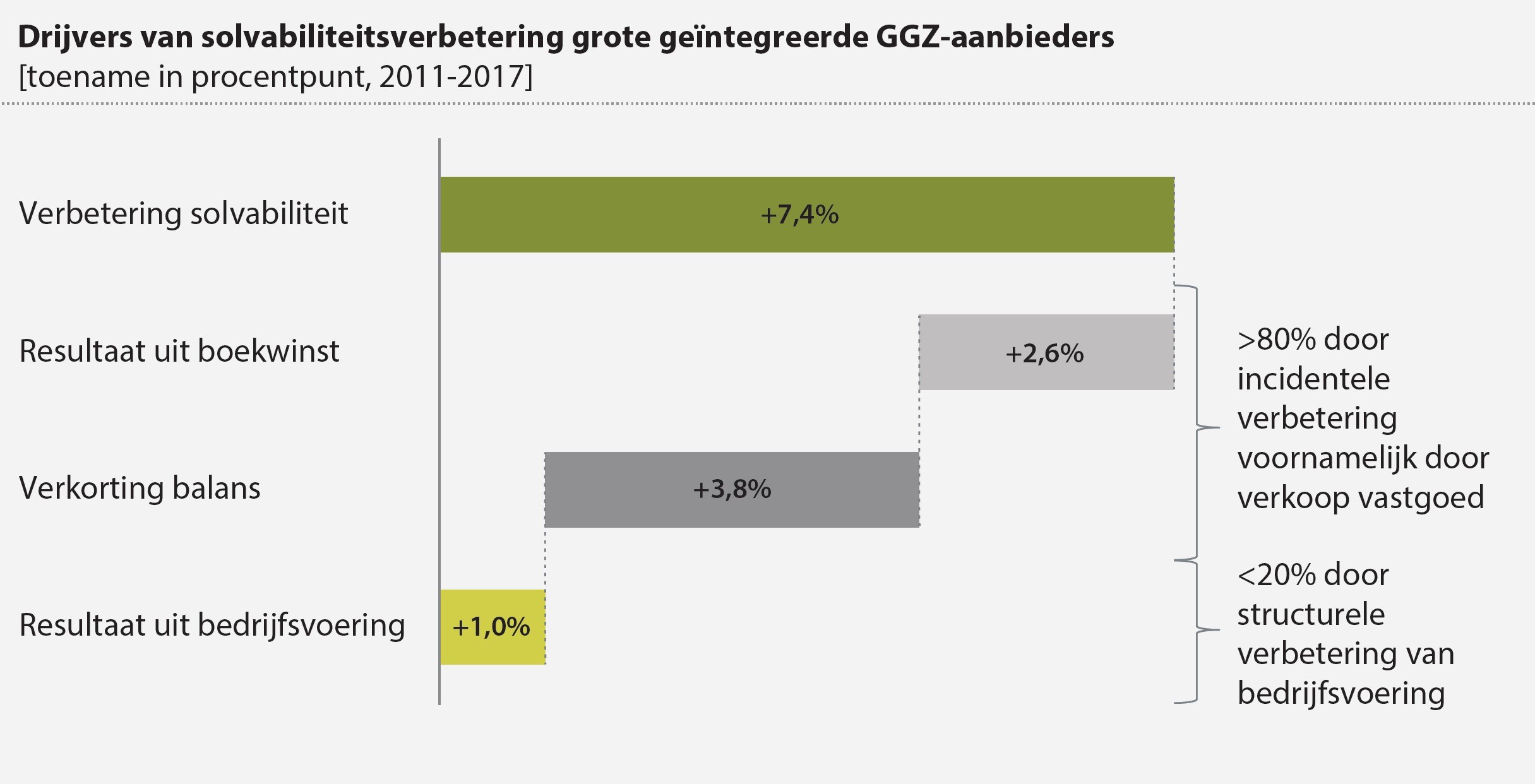

Between 2011 and 2017, the solvency of large integrated mental health care providers, a measure of financial resilience, grew by 7.4 percentage points (Figure 1). However, the sustainability of this increase appears to be limited. Incidental sources of income, primarily from the sale of real estate, are by far the most important reason for their improved financial health. They account for more than 80% of the increase in solvency. The contribution from normal business activities – providing health care – is minimal. This can be seen clearly when we adjust the providers’ financial results for incidental income: the improvements drop closer to zero. That means that once the incidental income evaporates, for example when all the real estate has been sold, the financial resilience of providers will in fact decrease.

Figure 1. Mental health care providers have improved solvency with a combination of income from capital gains, balance sheet reductions and profit from regular business activities. Note: The balance sheet reductions also include the effect of revaluation and system changes, which account for <1 percentage point of the solvency improvements.

If we look at individual providers, we see that nearly all the major integrated mental health care providers (20 out of 23) have incidental income that contributes to improving their solvency. Incidental income sources aside, more than half of the providers have healthy financial operations. However, the rest of the providers are suffering a loss on their business activities. Some of them can offset this loss with incidental income. But four of the providers actually saw their solvency decrease, despite their incidental income.

Based on the analysis in this study and conversations with managers of mental health care providers, we’ve uncovered three lessons for sustainably improving the financial position of this sector:

Read the article in NRC

Read the article in Skipr